Ant McPartlin was all smiles as he headed out on a stroll with baby Wilder and his wife Anne-Marie.

The couple welcomed their first child together last month. Anne-Marie, who previously worked for Ant as his PA, also shares two daughters with her former husband.

The proud parents looked to be caught up in new baby bliss as they enjoyed taking a walk with their little one and beloved pet dogs.

While Anne-Marie took charge of the pram, Ant was seen holding the lead of their Maltipoo dogs Milo

and Bumble and beloved Labrador Hurley, who he shares with his ex-wife Lisa Armstrong.

Last month Lisa appeared to offer a rare olive branch to the TV star, whom she divorced in 2018,

as she praised him and his best pal Declan Donnelly for their work on Saturday Night Takeaway. Ahead of their final ever episode, Lisa liked a post calling the duo ‘simply the best’ on a milestone night for them.

However, Lisa appeared to be a no-nonsense mood this Friday night as she took to Instagram to share a barbed posts about ‘d*ckheads.’ The Strictly make-up artist, who has amassed a large following online, has become renowned for her blunt and often inspirational quote posts.

On Friday, Lisa shared: “I saw a post that said: ‘If you want a happy and healthy life, you need to avoid d***heads not carbohydrates.’ I think we’d all benefit from hearing this today.”

She followed this up with a second barbed message that read: “You just have to let people be… be who they are, do what they do, act how they act, say what they say. Let them live their version of reality. Let them sit with their lies and delusion while you sit with the truth in peace.”

It’s been in a difficult year for Lisa who split with her electrician boyfriend after three years together. The break-up was said to have come like a ‘bolt out the blue’ with friends gushing about how loved up they were.

The source told the Daily Mai: “I don’t really know what has gone wrong. The two of them were only on a swanky holiday together in the Caribbean or somewhere about eight weeks ago. He was with her one day, and he just wasn’t with her the next day. There was no inkling that anything was wrong.”

Lisa started dating father-of-two James in 2020 when he was estranged from his wife Kirsty after moving out of their marital home in Hampshire.

Things will be looking up Lisa’s professional life this September when she joins the Strictly Come Dancing team in celebrating 20 years of the hit BBC show. Lisa has worked to transform some of Strictly’s best-loved couples for the much-loved dance show, winning scores of awards in the process. Viewers will have also seen her step out from the camera for her make-up tutorials on spin-off It Takes Two.

Lisa wasn’t always a make-up artist, she began her career in showbiz as a member of pop band Deuce. She went on to meet her husband Ant as the pair performed at a pop concert at Newcastle City Hall in 1994.

Follow us to see more useful information, as well as to give us more motivation to update more useful information for you.

Source: New York Post

Understanding Deductibles in Insurance

What is a Deductible?

A deductible is the amount of money a policyholder must pay out-of-pocket before an insurance company begins to cover the remaining costs. Deductibles are a fundamental component of most insurance policies, including health, auto, home, and business insurance.

How Do Deductibles Work?

When you file a claim, you are responsible for paying the deductible amount. Only after this amount is paid will the insurance company pay for the covered expenses exceeding the deductible. For example, if you have a $1,000 deductible on your car insurance and incur $3,000 in damages from an accident, you would pay the first $1,000, and the insurance company would cover the remaining $2,000.

Types of Deductibles

-

Fixed Dollar Deductible: This is a specific amount you must pay each time you file a claim. It’s common in health and auto insurance policies.

Percentage Deductible: In some cases, particularly with homeowners insurance, the deductible might be a percentage of the insured value. For instance, if your home is insured for $200,000 and you have a 2% deductible, your out-of-pocket cost would be $4,000 before insurance covers the rest.

Per-Claim vs. Annual Deductible:

Per-Claim Deductible: You pay the deductible every time you file a claim.

Annual Deductible: Common in health insurance, this deductible resets each year. You pay out-of-pocket until your total expenses reach the deductible amount for the year.

Why Do Deductibles Exist?

-

Cost Control: Deductibles help keep insurance premiums more affordable. Higher deductibles typically result in lower premiums because the policyholder assumes more initial risk.

Reduced Claims Frequency: Deductibles discourage policyholders from filing small or frivolous claims, reducing the number of claims an insurer must process and pay out.

Shared Responsibility: Deductibles ensure that policyholders share in the financial responsibility of their care or damages, promoting cautious behavior and maintenance of insured assets.

Choosing the Right Deductible

When selecting an insurance policy, choosing the right deductible is crucial. Here are some considerations:

-

Financial Ability: Assess your ability to pay the deductible in case of a claim. A higher deductible can lower your premium but may be challenging to pay if an incident occurs.

Risk Tolerance: Determine how much risk you are comfortable assuming. If you prefer lower out-of-pocket costs during an emergency, a lower deductible might be preferable, albeit with a higher premium.

Frequency of Claims: Consider how often you might need to file a claim. If you anticipate frequent claims, a lower deductible might be more cost-effective over time.

Impact on Premiums

The relationship between deductibles and premiums is inverse. Generally, the higher the deductible, the lower the premium, and vice versa. This trade-off allows policyholders to customize their insurance based on their financial situation and risk appetite.

Conclusion

Deductibles are a key feature of insurance policies that influence both the cost of premiums and the financial burden on policyholders when filing claims. Understanding how deductibles work and carefully selecting an appropriate deductible can help balance cost savings with financial protection, ensuring optimal insurance coverage tailored to individual needs and circumstances.

News

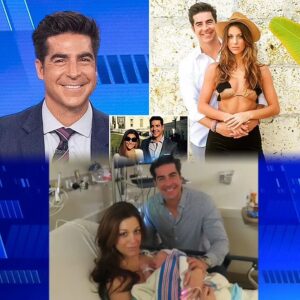

“Jesse Watters and Wife Emma DiGiovine Shock Fans with Surprise Baby News—Meet Their New Baby Girl and the Heartwarming Story Behind the Announcement!”

Fox’s Jesse Watters and wife Emma DiGiovine glow as they welcome new baby girl to the world FOX News host Jesse Watters and his wife Emma DiGiovine…

Linda Robson broke down in tears, saying she would DIE TOGETHER with her best friend Pauline Quirke on live television, leaving everyone stunned. What happened?

Linda Robson has spoken publicly about the heartbreaking dementia diagnosis of her long-time friend and Birds of a Feather co-star, Pauline Quirke. Last month, Pauline’s husband, Steve…

Pete Wicks Admits He ‘Cried Several Times’ Filming Emotional New Rescue Dog Series – The HEARTWARMING Moments That Left Him in TEARS!

‘They have transformed my life for the better’ Star of Strictly Pete Wicks admitted he “cried several times” while filming his new documentary, Pete Wicks: For Dogs’ Sake. A lover…

Gino D’Acampo just stirred up social networks with his FIRST POST after being fired from ITV

Celebrity chef and TV star Gino D’Acampo has been accused of sexual misconduct as over 40 people have come forward amid his alleged wrongdoing A defiant Gino D’Acampo has…

This Morning presenter prepares to become homeless, family home worth £4m about to disappear

The This Morning presenter lives in Richmond with his wife and children This Morning star Ben Shephard lives less than 30 minutes away from the ITV studios, in a beautiful home…

Stacey Solomon in tears and forced to walk off camera as Sort Your Life Out fans say ‘LIFE IS CRUEL’

Stacey Solomon had to step away from the camera, overwhelmed with emotion, while filming her show ‘Sort Your Life Out’ as she assisted a family from Leeds in decluttering their…

End of content

No more pages to load