Linda Robson has discussed Stacey Solomon’s future on ITV’s Loose Women. It comes after the Sort Your Life Out star has only appeared once on the panel show since 2022.

Linda, 66, disclosed that the mother-of-five is ‘too busy’ to commit to a full-time role in the show due to her involvement in various other projects.

Stacey has various TV projects – including her BBC show Sort Your Life Out and Channel 4 programme Renovation Rescue – as well as her own Primark Kids range.

Clothing range with In Your Style and her hair business Rehab.

Linda shared: ‘She’s not going to be a regular anymore? I don’t think so, but you never know. ‘I would love her to come back, she’s a really good Loose Woman – she’s really honest.

But I think she’s got too much on.

‘She’s got her own series and her and Joe are out in their little house. She’s still really welcome but she’s just so busy.” Stacey last appeared on the show in November.

Before that she had last appeared on Loose Women in 2022 before going on maternity leave to welcome her daughter Belle, who is now 15 months old. On her return to Loose Women in November last year, Stacey told viewers: ‘I am so happy to be here, I feel like I have missed so much.

‘It has been so crazy, because Belle was a wonderful surprise, but what that meant was that I had to fit my filming schedule into a very short period of time. I’ve just been up and down the country with Sort Your Life Out and filming another show so I haven’t been able to even get into town. And now I get to be with my actual friends again, for a catch-up, it’s like therapy being here. ‘.

Follow us to see more useful information, as well as to give us more motivation to update more useful information for you.

Source: New York Post

Asset Allocation: An Overview

Asset allocation is a crucial strategy in investment management that involves dividing an investment portfolio among different asset categories, such as stocks, bonds, real estate, and cash. The goal is to balance risk and reward by adjusting the proportion of each asset class based on the investor’s risk tolerance, time horizon, and financial goals.

Importance of Asset Allocation

Diversification: Spreading investments across various asset classes reduces the risk of a significant loss. If one asset class performs poorly, others may perform well, balancing the overall returns.

Risk Management: Different asset classes have different levels of risk and return. By allocating assets appropriately, investors can manage the overall risk of their portfolio.

Optimization of Returns: Proper asset allocation aims to maximize returns for a given level of risk.

Key Asset Classes

Stocks (Equities):

Represent ownership in a company.

Potential for high returns but come with higher risk.

Suitable for long-term growth.

Bonds (Fixed Income):

Loans made to a corporation or government in exchange for periodic interest payments and the return of principal at maturity.

Generally lower risk than stocks, providing more stable returns.

Suitable for income generation and preservation of capital.

Real Estate:

Physical property or investments in Real Estate Investment Trusts (REITs).

Provides potential for income through rent and appreciation in value.

Offers diversification benefits due to its lower correlation with stocks and bonds.

Cash and Cash Equivalents:

Includes money market funds, Treasury bills, and other short-term investments.

Lowest risk but also the lowest returns.

Provides liquidity and stability.

Factors Influencing Asset Allocation

Risk Tolerance:

The degree of variability in investment returns an investor is willing to withstand.

Higher risk tolerance generally leads to a higher allocation in stocks.

Time Horizon:

The expected period an investor plans to hold an investment.

Longer time horizons can justify higher allocations to stocks due to their potential for higher long-term returns.

Investment Goals:

Specific financial objectives, such as retirement, buying a house, or funding education.

Goals influence the required return and acceptable risk level.

Market Conditions:

Economic and market trends can impact asset performance.

Tactical adjustments may be made based on current conditions, though the core allocation usually remains aligned with long-term goals.

Strategies for Asset Allocation

Strategic Asset Allocation:

Establishing and adhering to a base asset mix that aligns with the investor’s long-term goals and risk tolerance.

Periodic rebalancing to maintain the target allocation.

Tactical Asset Allocation:

Short-term adjustments to the asset mix based on market conditions or economic outlook.

Aims to capitalize on favorable conditions while managing risk.

Dynamic Asset Allocation:

Continuously adjusting the asset mix in response to changing market conditions.

More flexible but requires active management and frequent monitoring.

Core-Satellite Allocation:

Combining a core portfolio that follows a strategic allocation with smaller, actively managed

satellite investments.

Allows for potential higher returns from satellite investments while maintaining a stable core.

Rebalancing

Rebalancing involves adjusting the portfolio to return to the target asset allocation. This can be done periodically (e.g., annually) or when asset classes deviate significantly from their target weights. Rebalancing helps maintain the desired risk level and can involve buying or selling assets to restore the original allocation.

Conclusion

Asset allocation is a fundamental aspect of building and managing an investment portfolio. By diversifying investments across different asset classes, investors can manage risk, optimize returns, and align their portfolios with their financial goals. Whether following a strategic or more active approach, understanding and applying asset allocation principles is key to long-term investment success.

News

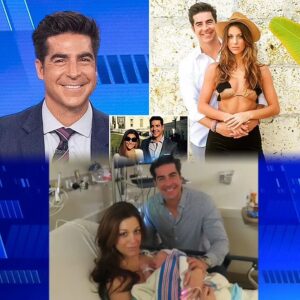

“Jesse Watters and Wife Emma DiGiovine Shock Fans with Surprise Baby News—Meet Their New Baby Girl and the Heartwarming Story Behind the Announcement!”

Fox’s Jesse Watters and wife Emma DiGiovine glow as they welcome new baby girl to the world FOX News host Jesse Watters and his wife Emma DiGiovine…

Linda Robson broke down in tears, saying she would DIE TOGETHER with her best friend Pauline Quirke on live television, leaving everyone stunned. What happened?

Linda Robson has spoken publicly about the heartbreaking dementia diagnosis of her long-time friend and Birds of a Feather co-star, Pauline Quirke. Last month, Pauline’s husband, Steve…

Pete Wicks Admits He ‘Cried Several Times’ Filming Emotional New Rescue Dog Series – The HEARTWARMING Moments That Left Him in TEARS!

‘They have transformed my life for the better’ Star of Strictly Pete Wicks admitted he “cried several times” while filming his new documentary, Pete Wicks: For Dogs’ Sake. A lover…

Gino D’Acampo just stirred up social networks with his FIRST POST after being fired from ITV

Celebrity chef and TV star Gino D’Acampo has been accused of sexual misconduct as over 40 people have come forward amid his alleged wrongdoing A defiant Gino D’Acampo has…

This Morning presenter prepares to become homeless, family home worth £4m about to disappear

The This Morning presenter lives in Richmond with his wife and children This Morning star Ben Shephard lives less than 30 minutes away from the ITV studios, in a beautiful home…

Stacey Solomon in tears and forced to walk off camera as Sort Your Life Out fans say ‘LIFE IS CRUEL’

Stacey Solomon had to step away from the camera, overwhelmed with emotion, while filming her show ‘Sort Your Life Out’ as she assisted a family from Leeds in decluttering their…

End of content

No more pages to load