The fairy tale lives of Prince Harry and Meghan Markle have hit a major financial roadblock. The royal couple, who famously stepped back from their duties in the British royal family in 2020, have revealed that they are now facing a staggering $6 million in debt. For years, Harry and Meghan have been living a life of luxury, splurging on lavish vacations, expensive cars, and a palatial estate in California. However, their overspending has finally caught up with them as their primary source of income, their YouTube channel, has seen a significant decline in revenue in recent years.

The Rise and Fall of Archwell Audio

The couple, who have 2.5 million subscribers on their Archwell Audio YouTube channel, long relied on their online presence to fund their extravagant lifestyle. At its peak, their channel was a massive success, with millions of views and lucrative sponsorships. They envisioned raking in millions of dollars through sponsorships and brand deals, but the reality is that their content just hasn’t been resonating with viewers the way they hoped.

“Harry and Meghan really thought their YouTube channel would be a gold mine for them,” said royal commentator Emily Andrews. “They envisioned raking in millions of dollars through sponsorships and brand deals, but the reality is their content just hasn’t been resonating with viewers the way they hoped.”

As viewership and engagement have dropped, the couple has been unable to keep up with their lavish spending habits. Their income from YouTube, which once seemed like a limitless fountain of wealth, has dwindled, forcing them to seek alternative sources of income.

Desperate Measures

In a desperate attempt to earn more money and pay down their debts, the couple has turned to various other business ventures, including online courses and promoting brand partnerships. However, these efforts have largely fallen flat, failing to generate the kind of income they need to maintain their luxurious lifestyle.

“They’ve tried everything from peddling dubious online courses to shilling for questionable brands,” said entertainment journalist Perez Hilton. “But nothing seems to be sticking. Their spending is just outpacing what they’re able to bring in these days.”

With their backs against the wall, Harry and Meghan have now resorted to soliciting donations from loyal fans through their Archwell Foundation. The couple has been actively encouraging their followers to contribute financially to help them weather the storm.

A Fall from Grace

“It’s a really remarkable fall from grace,” commented royal historian David Starkey. “These two were once global superstars, able to command massive sums for just about anything they did. And now they’re begging their fans for money. It’s a stunning reversal of fortune for Harry and Meghan.”

Their financial woes are a cautionary tale about the dangers of living beyond one’s means. Their lavish spending, fueled by the false assumption that their YouTube fame would last forever, has left them in a precarious position.

“They got way too comfortable thinking the money would just keep rolling in,” said financial analyst Emma Watkins. “But the reality is YouTube income can be very volatile, and if you’re not careful, you can easily find yourself in a massive hole that’s very difficult to dig out of.”

Lessons for Influencers

The couple’s predicament also serves as a wake-up call for other influencers and content creators who rely on unstable income streams. While the allure of a luxurious lifestyle may be tempting, it’s crucial to maintain financial discipline and live within one’s means to avoid a similar fate.

“Harry and Meghan’s story should be a lesson to anyone who’s making money online,” said personal finance expert Michael Batnick. “You have to be really smart and strategic about how you manage that money because the minute your audience starts to wane, you could be in big trouble.”

Their situation highlights the volatility of online fame and the importance of financial prudence. The couple’s fall from financial grace is a stark reminder that even the most seemingly stable sources of income can dry up, leaving one vulnerable if they haven’t planned accordingly.

The Road Ahead

As Harry and Meghan continue to grapple with their financial woes, the world will be watching to see how they navigate this challenging chapter in their lives. Will they be able to dig themselves out of debt and regain their financial footing? Or will their lavish lifestyle ultimately be their undoing? Only time will tell.

In the meantime, they are reportedly cutting back on some of their extravagant expenses and looking for more stable and sustainable sources of income. Their plight serves as a reminder to live within one’s means and not to rely too heavily on any single source of income, especially in the unpredictable world of online content creation.

A Teachable Moment

Harry and Meghan’s financial troubles are more than just a tabloid story; they are a teachable moment for everyone, whether involved in online business or not. The importance of financial literacy, planning, and living within one’s means cannot be overstated. Their experience underscores the necessity of being prepared for financial uncertainties and the value of building a diversified income portfolio.

Their journey from royalty to financial struggle is a modern-day cautionary tale that resonates beyond the glitz and glamour of celebrity life. It’s a powerful reminder that no matter how much money one might have, poor financial management can lead to dire consequences.

As the couple works to overcome their financial difficulties, their story remains a poignant example of the challenges of maintaining wealth and the importance of financial responsibility. For Harry and Meghan, the road to financial recovery may be long and arduous, but it is also a journey that holds valuable lessons for everyone about the importance of prudent financial planning and the perils of living beyond one’s means.

News

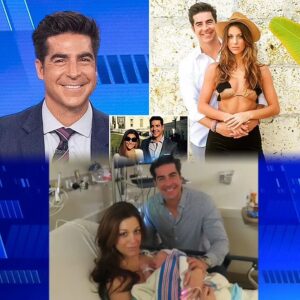

“Jesse Watters and Wife Emma DiGiovine Shock Fans with Surprise Baby News—Meet Their New Baby Girl and the Heartwarming Story Behind the Announcement!”

Fox’s Jesse Watters and wife Emma DiGiovine glow as they welcome new baby girl to the world FOX News host Jesse Watters and his wife Emma DiGiovine…

Linda Robson broke down in tears, saying she would DIE TOGETHER with her best friend Pauline Quirke on live television, leaving everyone stunned. What happened?

Linda Robson has spoken publicly about the heartbreaking dementia diagnosis of her long-time friend and Birds of a Feather co-star, Pauline Quirke. Last month, Pauline’s husband, Steve…

Pete Wicks Admits He ‘Cried Several Times’ Filming Emotional New Rescue Dog Series – The HEARTWARMING Moments That Left Him in TEARS!

‘They have transformed my life for the better’ Star of Strictly Pete Wicks admitted he “cried several times” while filming his new documentary, Pete Wicks: For Dogs’ Sake. A lover…

Gino D’Acampo just stirred up social networks with his FIRST POST after being fired from ITV

Celebrity chef and TV star Gino D’Acampo has been accused of sexual misconduct as over 40 people have come forward amid his alleged wrongdoing A defiant Gino D’Acampo has…

This Morning presenter prepares to become homeless, family home worth £4m about to disappear

The This Morning presenter lives in Richmond with his wife and children This Morning star Ben Shephard lives less than 30 minutes away from the ITV studios, in a beautiful home…

Stacey Solomon in tears and forced to walk off camera as Sort Your Life Out fans say ‘LIFE IS CRUEL’

Stacey Solomon had to step away from the camera, overwhelmed with emotion, while filming her show ‘Sort Your Life Out’ as she assisted a family from Leeds in decluttering their…

End of content

No more pages to load